Investing in cryptocurrency for beginners can be a daunting topic, especially given the industry’s recent tumultuous fluctuations. From a $3 trillion valuation to now sitting under $1 trillion, the cryptocurrency market has experienced significant volatility.

However, this volatility has also presented opportunities for those looking to invest and trade these digital assets. With the likes of Bitcoin and Ethereum rising astronomically since their inception, many individuals are eager to learn how to invest in cryptocurrency and potentially reap the rewards of this burgeoning market.

In this comprehensive step-by-step guide, we will provide you with all the essential information you need to know as a beginner to start investing in cryptocurrency. We’ll cover everything from selecting a reliable cryptocurrency exchange, creating a wallet, understanding the fundamentals of crypto trading, and managing your investments.

So, whether you’re a seasoned investor looking to expand your portfolio or a curious newbie keen on taking the plunge, this guide is for you. Get ready to embark on your journey into the exciting world of cryptocurrency investment!

Understanding Cryptocurrency

Cryptocurrency is a digital or virtual currency that operates independently of central banks, using encryption techniques to secure and verify transactions on a decentralized digital ledger called the blockchain.

Cryptocurrency for beginners can be a complex and overwhelming concept to grasp, but it is essential to have a basic understanding before investing in this volatile market.

How cryptocurrency works?

Cryptocurrency transactions are recorded on a decentralized digital ledger called the blockchain. Every transaction is encrypted and verified by a network of users, eliminating the need for intermediaries such as banks, governments, or other financial institutions.

Instead, the blockchain technology serves as a distributed public ledger, where each transaction is confirmed and verified by the network of users, making it secure and immutable.

Types of cryptocurrency:

There are several types of cryptocurrencies available in the market, each with its unique features, such as speed of transactions and security protocols.

The most well-known cryptocurrency is Bitcoin, which was created in 2009. Ethereum, Litecoin, Ripple, and Tether are other popular cryptocurrencies.

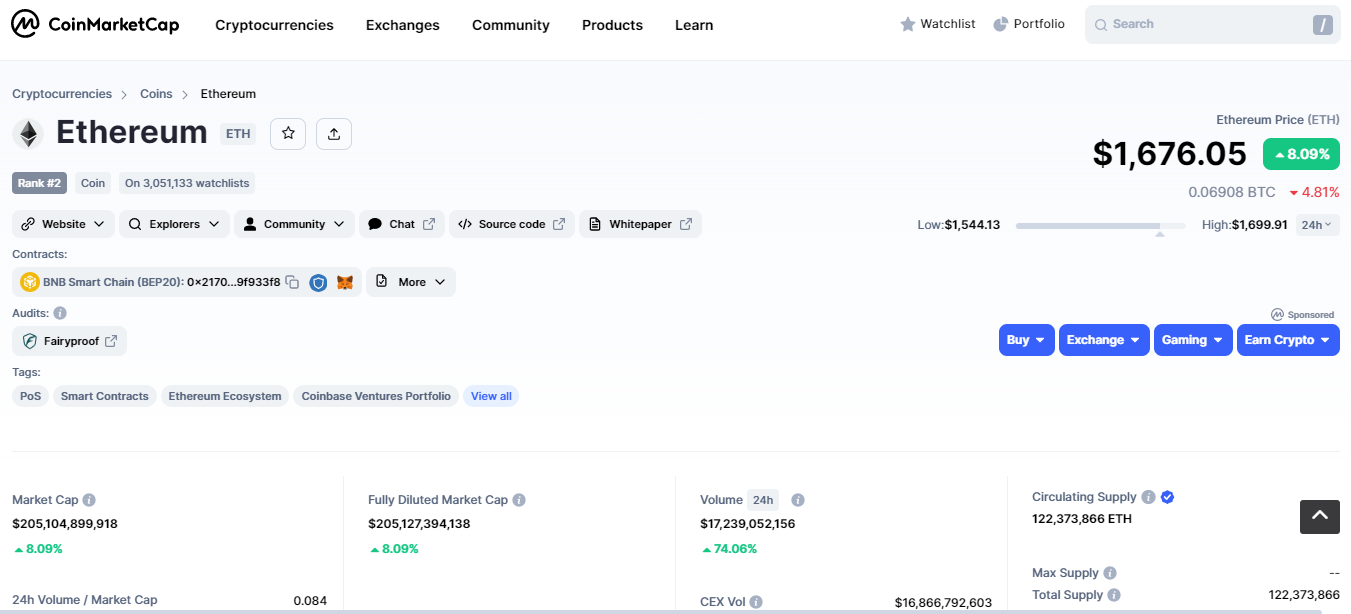

Ethereum, in particular, has gained traction due to its smart contract capabilities, enabling developers to build decentralized applications on top of its blockchain. As of writing, Ethereum has a market cap of over $2 billion.

Cryptocurrency exchanges

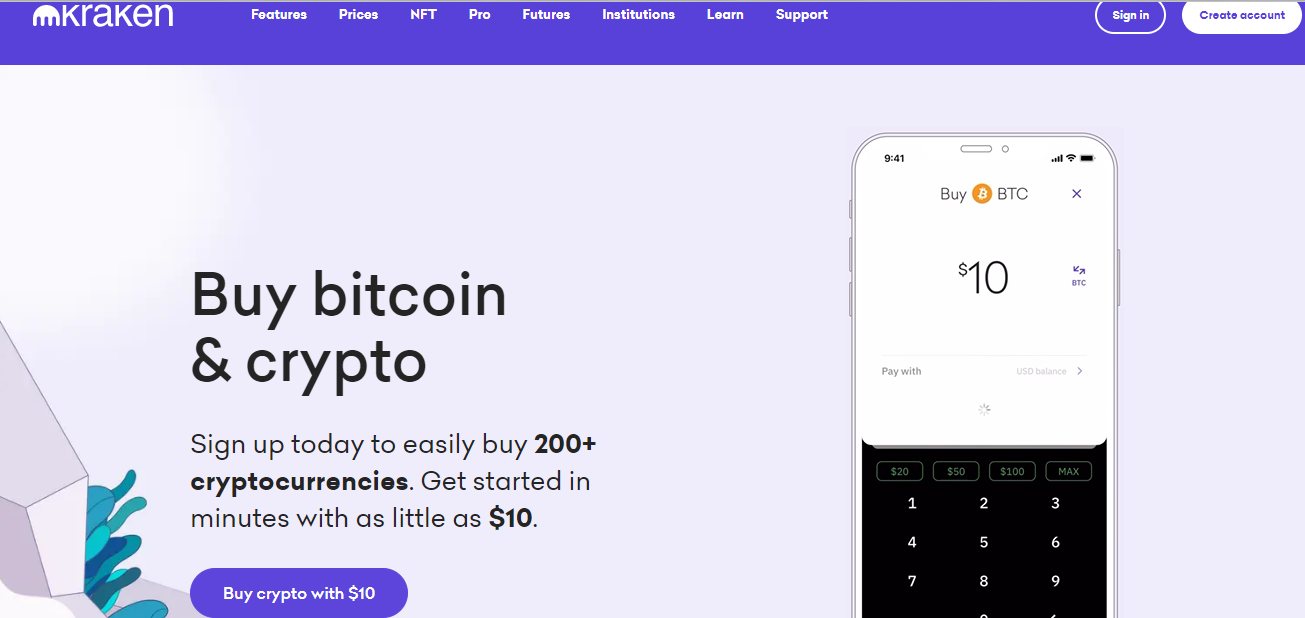

To invest in crypto, one needs to create an account on a cryptocurrency exchange. These platforms allow users to buy, sell, and store cryptocurrencies, as well as convert them to traditional currencies. Coinbase, Binance, and Kraken are popular exchanges, but it is essential to research and choose a reliable and trustworthy platform to ensure security.

Understanding the fundamentals of cryptocurrency is crucial before investing in this volatile market. By grasping how it works, the different types available, and where to trade, beginners can build a solid foundation and make informed investment decisions.

However, it’s essential to exercise caution and do thorough research to avoid scams and fraudulent activities that are prevalent in this industry.

Factors to Consider Before Investing in Cryptocurrency

Cryptocurrency is a digital currency that operates independently of a central bank. Starting with Bitcoin, today, we have over 5,000 cryptocurrencies with different teams and purposes around us.

Surely, it has become increasingly popular in recent years, with many people investing in various cryptocurrencies like Bitcoin, Ethereum, Dogecoin, Ripple, and others.

However, before investing in cryptocurrency, there are several factors to consider.

Risk vs Reward

The cryptocurrency market is known for its high-risk and high-reward potential. The market is highly volatile, with prices fluctuating rapidly based on various factors, including demand, supply, adoption, and regulation.

Investing in cryptocurrency can provide significant rewards, as seen in the significant growth of cryptocurrencies like Bitcoin, Ethereum, and Dogecoin over the past few years. According to CoinMarketCap, the market capitalization of the cryptocurrency market reached $3 trillion in 2022, up from just $17 billion in 2017. Bitcoin, the most popular cryptocurrency, has seen a surge in value from less than $1 in 2010 to its all-time high of $68,789.63 in 2021.

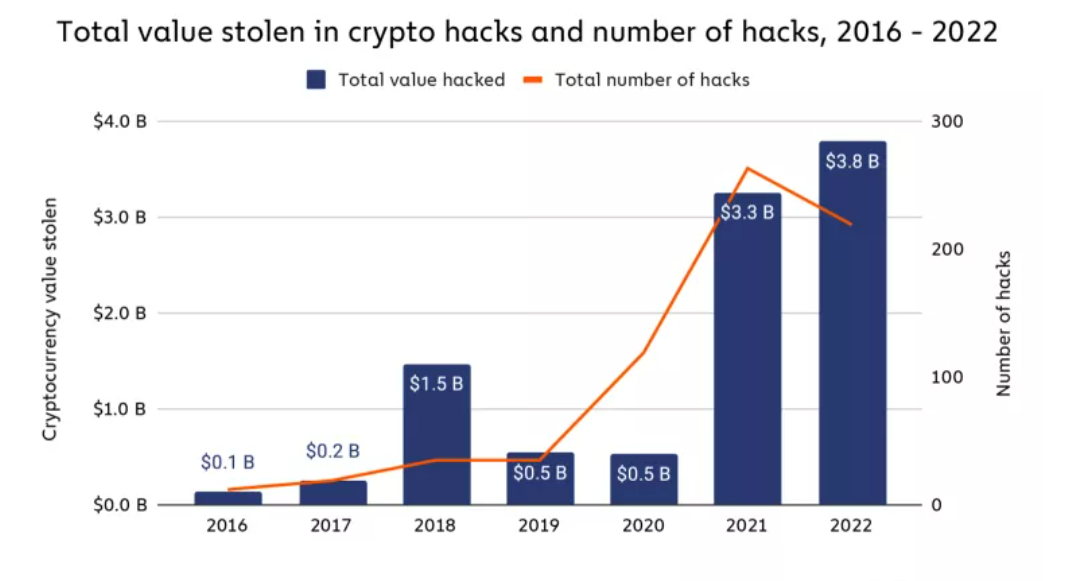

However, the cryptocurrency market is also highly risky. The market is unregulated, and the lack of oversight means that there is a higher potential for fraudulent activities and scams. Hackers can also target cryptocurrency exchanges and steal investors’ funds.

Moreover, the cryptocurrency market is highly unpredictable, and investors must be prepared for sudden price drops. For example, in 2018, the cryptocurrency market experienced a significant decline, with the total market capitalization dropping from $813 billion in January to $129 billion in December.

Security

Cryptocurrency investments are highly susceptible to theft, fraud, and hacking. According to Chainalysis, 2022, unfortunately, happened to be the biggest year for crypto hacking where the crypto industry saw over $3.8 billion stolen which was an increase of 15% from 2021.

Therefore, it is essential to invest in a reputable and secure cryptocurrency exchange that provides adequate security measures like two-factor authentication, cold storage, and encryption. It is also advisable to avoid storing large amounts of cryptocurrency in hot wallets or on exchanges.

Regulation

Cryptocurrency regulations are still in the early stages of development, with most countries still trying to figure out how to handle cryptocurrency. The lack of regulation makes it easier for scams and fraudulent activities to occur in the market.

However, some countries like Japan, Switzerland, and Malta have introduced regulations to support cryptocurrency trading. Before investing in cryptocurrency, investors should research the regulatory environment in their country and make informed decisions.

How to Invest in Cryptocurrency as a Beginner

Investing in cryptocurrency has the potential to yield high returns, but it also involves high risks. This section includes a cryptocurrency for beginners guide that will walk you through the process of investing in cryptocurrencies.

Choosing a Cryptocurrency Exchange

Before investing in cryptocurrencies, you need to choose a cryptocurrency exchange. A cryptocurrency exchange is a platform that allows you to buy, sell, and trade cryptocurrencies. There are many cryptocurrency exchanges to choose from, but not all of them are created equal. Some of the most popular cryptocurrency exchanges include Coinbase, Binance, Kraken, and Bitstamp.

When choosing a cryptocurrency exchange, you should consider factors such as security, fees, user interface, and supported cryptocurrencies. You should also check if the exchange is licensed and regulated by a reputable authority. According to Forbes, there are over 500 cryptocurrency exchanges worldwide, and their number is growing rapidly.

Creating an Account

After choosing a cryptocurrency exchange, the next step is to create an account. Creating an account is a straightforward process that involves providing your personal details, such as your name, email address, and phone number. Some exchanges may require additional verification steps, such as submitting a government-issued ID or a proof of address.

When creating an account, you should choose a strong password and enable two-factor authentication (2FA) to enhance the security of your account.

Funding Your Account

Once you have created an account, the next step is to fund it. Funding your account involves depositing funds into the exchange’s wallet using a payment method such as a credit card, bank transfer, or PayPal. Each exchange has its own funding methods and fees, so you should check them before depositing funds.

Making Your First Investment

After funding your account, you can start investing in cryptocurrencies. Before making your first investment, you should research the cryptocurrencies you want to invest in and their market trends. You should also diversify your portfolio to minimize your risks and maximize your returns.

According to a report by the investment firm Grayscale, the total value of assets under management (AUM) in its cryptocurrency trusts reached $25.5 billion in February 2021, indicating growing institutional interest in cryptocurrencies. Investing in cryptocurrencies is a high-risk, high-reward venture, and you should only invest what you can afford to lose.

Investing in cryptocurrencies can be a lucrative venture, but it requires knowledge, research, and caution. In this guide, we have covered the basic steps to invest in cryptocurrencies as a beginner, including choosing a cryptocurrency exchange, creating an account, funding your account, and making your first investment. Remember to only invest what you can afford to lose and to secure your cryptocurrency assets.

Common Strategies for Investing in Cryptocurrency

Cryptocurrency is a relatively new asset class that has gained immense popularity in recent years. However, investing in cryptocurrency can be risky, volatile, and complex. Therefore, it is essential to adopt a sound investment strategy to maximize your potential returns while minimizing your risks. Here are some common strategies for investing in cryptocurrency:

HODLing

HODLing is a long-term investment strategy in which an investor buys and holds cryptocurrency for an extended period, usually years, with the belief that its value will increase over time. This strategy is based on the belief that the cryptocurrency market is volatile and that prices will rise over the long term, despite short-term price fluctuations.

HODLing requires patience, as investors must be willing to withstand significant market fluctuations and hold their assets through periods of market downturns. The strategy can be particularly effective for investors who believe in the long-term viability of a particular cryptocurrency project.

Trading

Trading is an active investment strategy in which an investor buys and sells cryptocurrency frequently to profit from short-term price movements. This strategy requires a deep understanding of technical analysis, market trends, and trading strategies.

Trading can be risky and complex, and it requires investors to monitor the market constantly. However, it can also be a profitable strategy for experienced investors who can identify trends and capitalize on them quickly.

Diversification

Diversification is a strategy that involves spreading an investment portfolio across different asset classes, such as stocks, bonds, and cryptocurrencies, to reduce overall risk. This strategy aims to minimize the impact of any single asset’s performance on the portfolio’s overall performance.

Diversification can be particularly effective for cryptocurrency investors as the cryptocurrency market is volatile and can be subject to significant fluctuations. By spreading their investment across different cryptocurrencies, investors can reduce their exposure to any single asset’s risks.

Dollar-cost averaging

Dollar-cost averaging is an investment strategy that involves investing a fixed amount of money into an asset, such as cryptocurrency, at regular intervals, regardless of the asset’s price. This strategy aims to reduce the impact of short-term price fluctuations on an investor’s overall investment.

Dollar-cost averaging can be particularly effective for cryptocurrency investors who want to invest over the long term but are concerned about the asset’s volatility. By investing a fixed amount at regular intervals, investors can take advantage of both market downturns and upswings, averaging out the price of their investments over time.

Tips for Investing in Cryptocurrency for Beginners

Investing in cryptocurrency can be an exciting but daunting experience for beginners. With the volatile nature of the market, it’s important to take some precautions to avoid losing your investment. Here are some tips to help you get started:

Research and Due Diligence

Before investing in cryptocurrency, it’s crucial to do your research and due diligence. You should understand what cryptocurrency is, how it works, and its potential risks and rewards.

Familiarize yourself with the different types of cryptocurrencies and their unique features. Additionally, research the market trends and the current events that might affect the value of your investment.

Start with Small Amounts

As a beginner, it’s advisable to start small and invest only what you can afford to lose. This approach allows you to test the waters and gain some experience before committing more significant amounts. Consider investing small amounts in different cryptocurrencies to diversify your portfolio.

Don’t Invest More Than You Can Afford to Lose

Cryptocurrency is a high-risk investment, and it’s crucial to invest only what you can afford to lose. Avoid putting your life savings or emergency funds into cryptocurrency. Always prioritize your basic needs and financial security before considering investing in cryptocurrency.

Keep Track of Your Investments

It’s essential to keep track of your cryptocurrency investments. You should know the value of your investments at any given time and keep a record of your transactions. Consider using a cryptocurrency portfolio tracker to monitor your investments and track their performance.

Stay Updated with Cryptocurrency News

The cryptocurrency market is constantly evolving, and it’s essential to stay updated with the latest news and trends. Follow reputable sources and stay informed on significant events that might affect the market. Being up-to-date can help you make informed decisions about your investments.

Alternative Cryptocurrency Investment Options

Despite direct cryptocurrency investment being the most prevalent method, there are alternative paths to enter the crypto market. Some of these options are more direct than others. These methods include:

Cryptocurrency Futures:

Futures trading provides another avenue for speculating on Bitcoin price changes. With the aid of leverage, traders can gain sizeable profits (or losses). Futures trading in cryptocurrency is fast-paced and exacerbates the already volatile movements in cryptocurrency prices.

Cryptocurrency Funds:

The Grayscale Bitcoin Trust is one of several crypto funds that offer investors exposure to Bitcoin, Ethereum, and some other altcoins’ price fluctuations. These funds make buying crypto convenient through an investment product similar to a fund.

Cryptocurrency Exchange or Broker Stocks:

Investing in the stock of a company that benefits from cryptocurrency growth, regardless of the winner, is also a viable option. Consider a cryptocurrency exchange such as Coinbase or a broker such as Robinhood, which generates a substantial portion of its income from crypto trading.

Blockchain ETFs:

A blockchain ETF invests in companies likely to benefit from the emergence of blockchain technology. The top blockchain ETFs offer exposure to some of the most prominent publicly traded companies in this sector.

However, it’s important to note that these firms typically engage in more than just cryptocurrency-related activities, diluting your exposure to cryptocurrency and reducing your potential upside and downside.

Each of these methods has varying degrees of risk and cryptocurrency exposure. Therefore, it’s essential to comprehend the investment product you’re purchasing and whether it aligns with your investment objectives.

FAQs:

What is cryptocurrency for beginners?

Cryptocurrency refers to a digital asset that uses cryptography to secure its transactions and to control the creation of new units. It operates independently of central banks and can be used to purchase goods and services or to invest in.

What are the benefits of investing in cryptocurrency for beginners?

Investing in cryptocurrency offers potential high returns and diversification in a portfolio. It is also accessible, with many online platforms offering low barriers to entry, making it easy for beginners to invest.

How much money do I need to start investing in cryptocurrency?

There is no set amount of money required to start investing in cryptocurrency. You can start with as little as $10 or less, depending on the platform you use. However, it’s important to remember that cryptocurrency markets can be volatile, and investing in them involves risk. You should only invest what you can afford to lose and do your research before investing in any particular cryptocurrency.

What are Altcoins?

Altcoins are alternative cryptocurrencies to Bitcoin, which was the first cryptocurrency to gain widespread attention and adoption. Altcoins may have different features, use cases, and mining algorithms than Bitcoin, but they are all based on the same underlying technology called blockchain. Some popular examples of altcoins include Ethereum, Ripple, Litecoin, and Bitcoin Cash. Many investors view altcoins as a way to diversify their cryptocurrency portfolios beyond Bitcoin.

What are the risks of investing in cryptocurrency for beginners?

Cryptocurrency is a highly volatile investment, with prices fluctuating rapidly and sometimes unpredictably. Additionally, cryptocurrency markets are not regulated, and there is a risk of fraud, hacking, and theft. Beginners need to do their research, understand the risks, and invest wisely.

What is the best strategy for investing in cryptocurrency for beginners?

The best strategy is to start small and gradually increase investment amounts as you gain more knowledge and experience. It’s essential to diversify your portfolio and not to put all your eggs in one basket. Investing in reputable cryptocurrencies, such as Bitcoin and Ethereum, is also a good place to start.

How can beginners get started with investing in cryptocurrency?

To get started, beginners can sign up for a reputable cryptocurrency exchange, such as Coinbase or Binance, and link their bank account to fund their account. They can then purchase cryptocurrency and store it in a secure digital wallet. It’s essential to do research, understand the risks, and seek advice before investing.

Conclusion – Investing in Cryptocurrency for Beginners

In conclusion, investing in cryptocurrency can be a profitable venture if approached with caution and a solid understanding of the market. As a beginner, it is important to start small, research extensively, and diversify your portfolio.

By following the step-by-step guide outlined in this article, you can be well on your way to investing in cryptocurrency with confidence. However, it is crucial to remember that the cryptocurrency market is volatile and risky, and therefore, it is important to exercise due diligence, monitor your investments closely, and only invest what you can afford to lose.